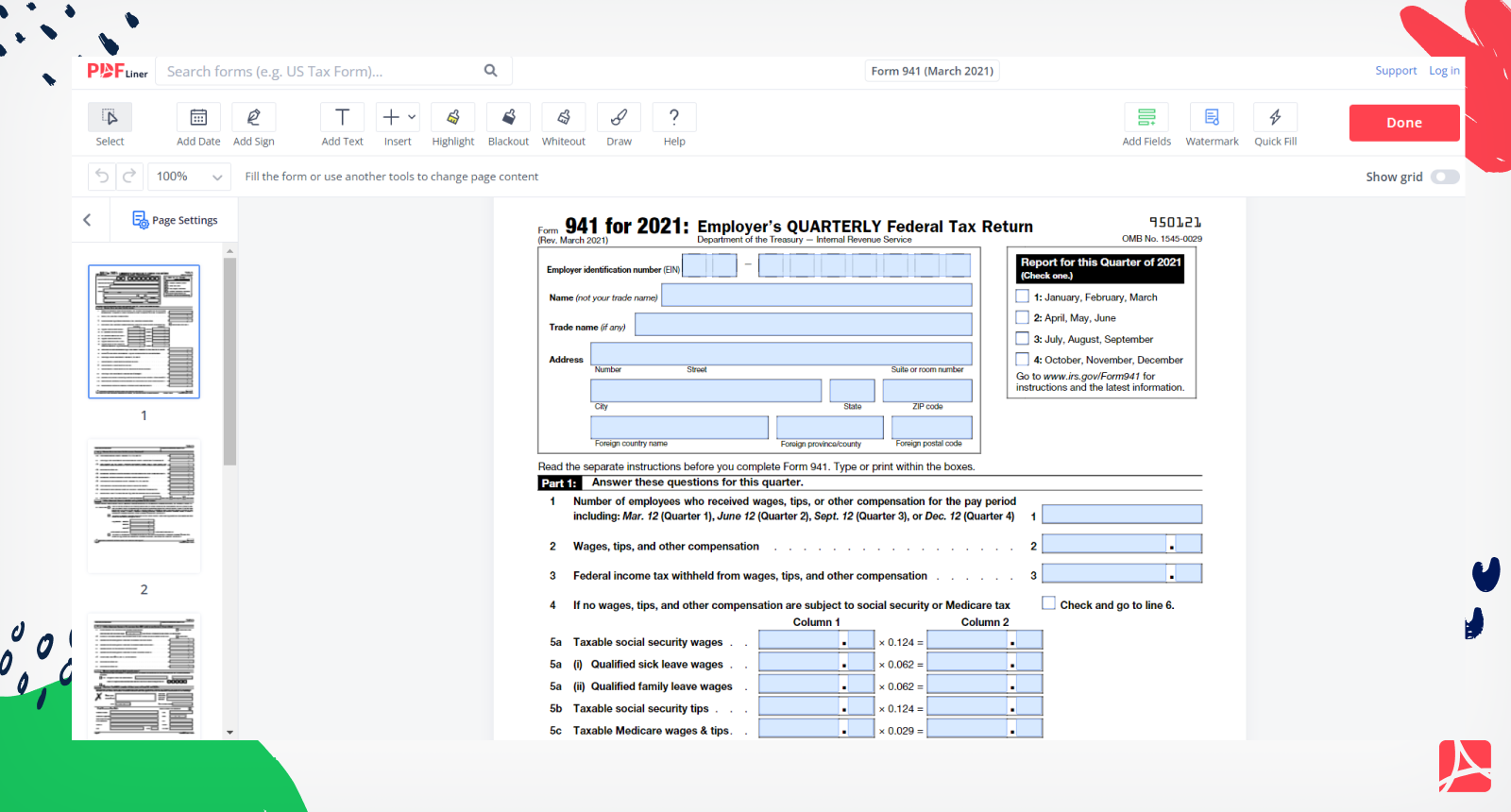

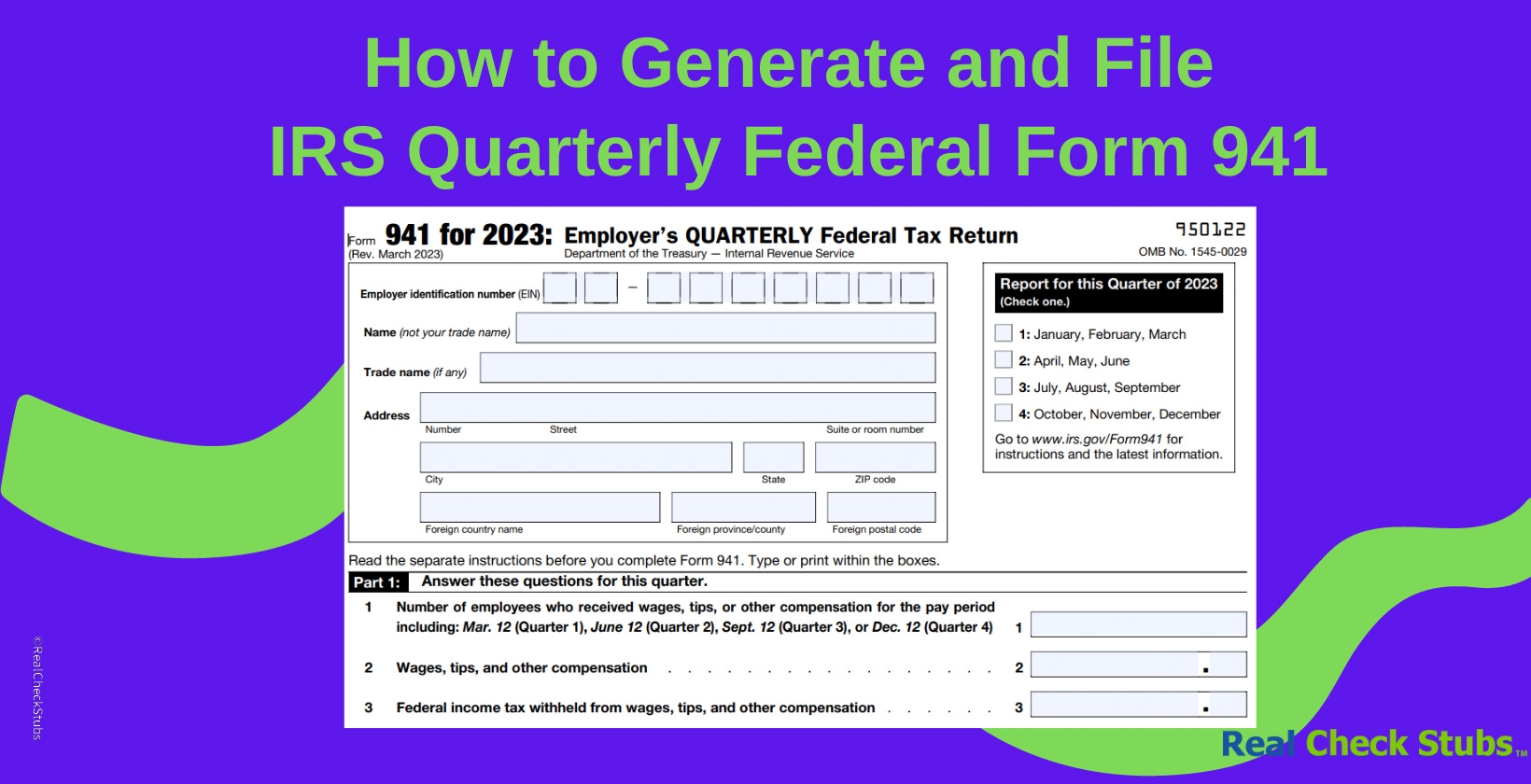

Are you looking for a simple and convenient way to file your business taxes? Look no further than the printable 941 form. This form is essential for employers to report wages paid and taxes withheld for employees.

By using the printable 941 form, you can easily report your quarterly payroll taxes to the IRS. This form helps you stay compliant with tax regulations and ensures that your employees receive the proper tax documentation.

Printable 941 Form

Printable 941 Form: A Must-Have for Businesses

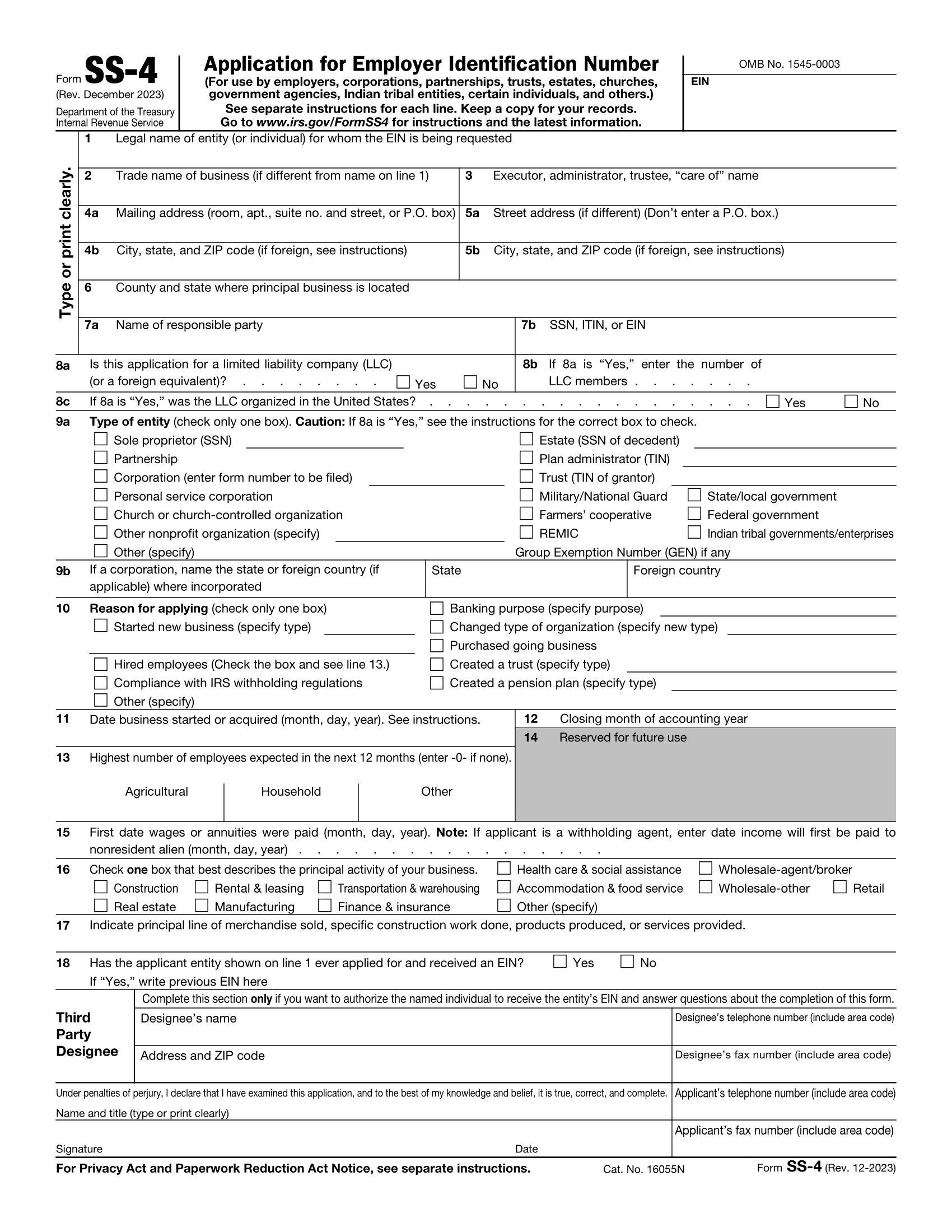

With the printable 941 form, you can accurately report federal income tax, social security tax, and Medicare tax withheld from your employees’ paychecks. This form is essential for calculating and reporting your employer tax liabilities.

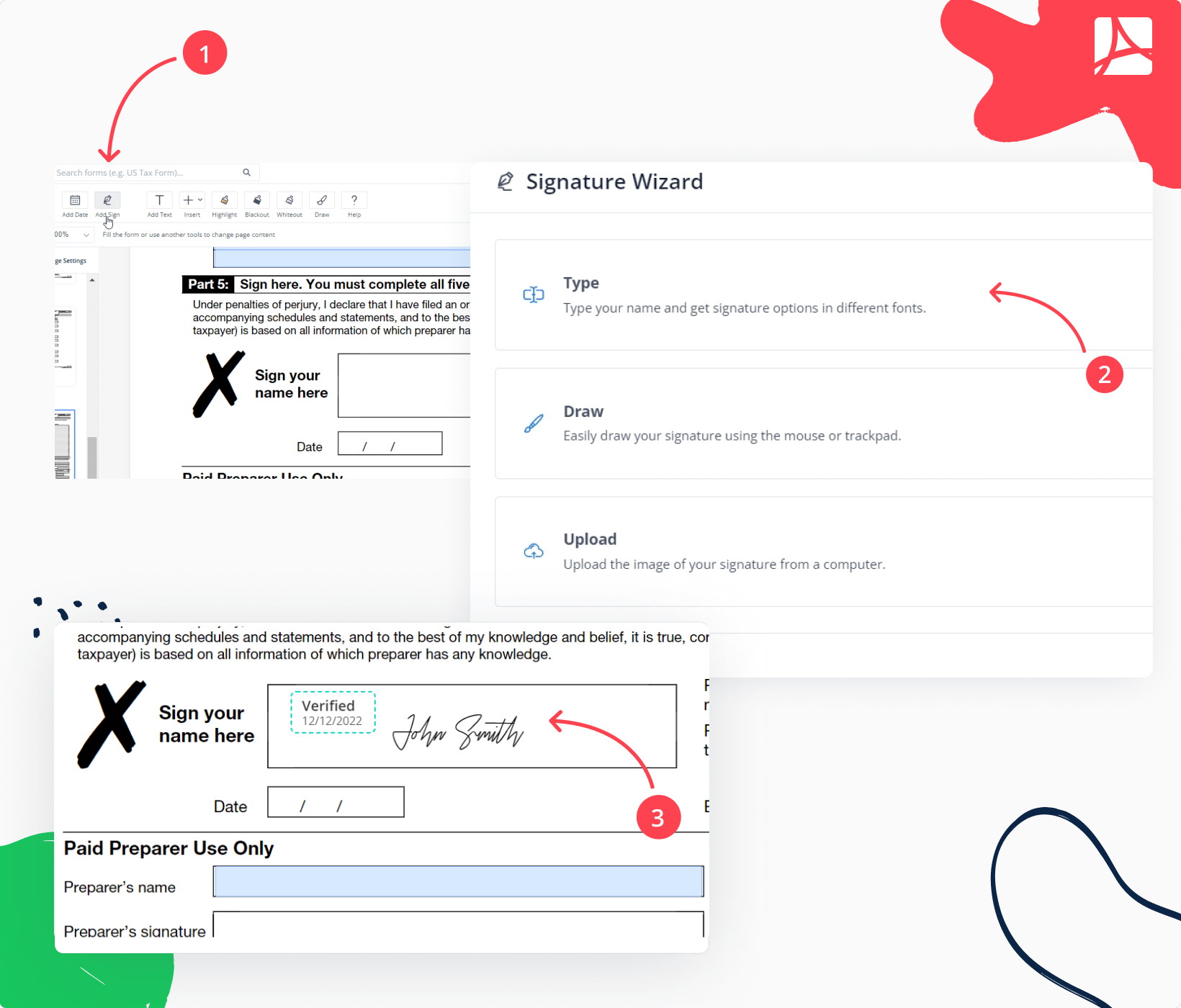

Using the printable 941 form simplifies the process of reporting your quarterly payroll taxes. By filling out this form accurately and on time, you can avoid penalties and interest charges from the IRS.

Don’t let tax season stress you out. Take advantage of the printable 941 form to streamline your payroll tax reporting process. With this form, you can ensure that your business remains compliant with tax laws and regulations.

In conclusion, the printable 941 form is a valuable tool for businesses to report their quarterly payroll taxes accurately. By using this form, you can stay compliant with tax regulations and avoid penalties from the IRS. Make tax season a breeze with the printable 941 form!

Form 941 March 2021 Printable Blank Form Online PDFliner

How To Generate And File IRS Quarterly Federal Form 941

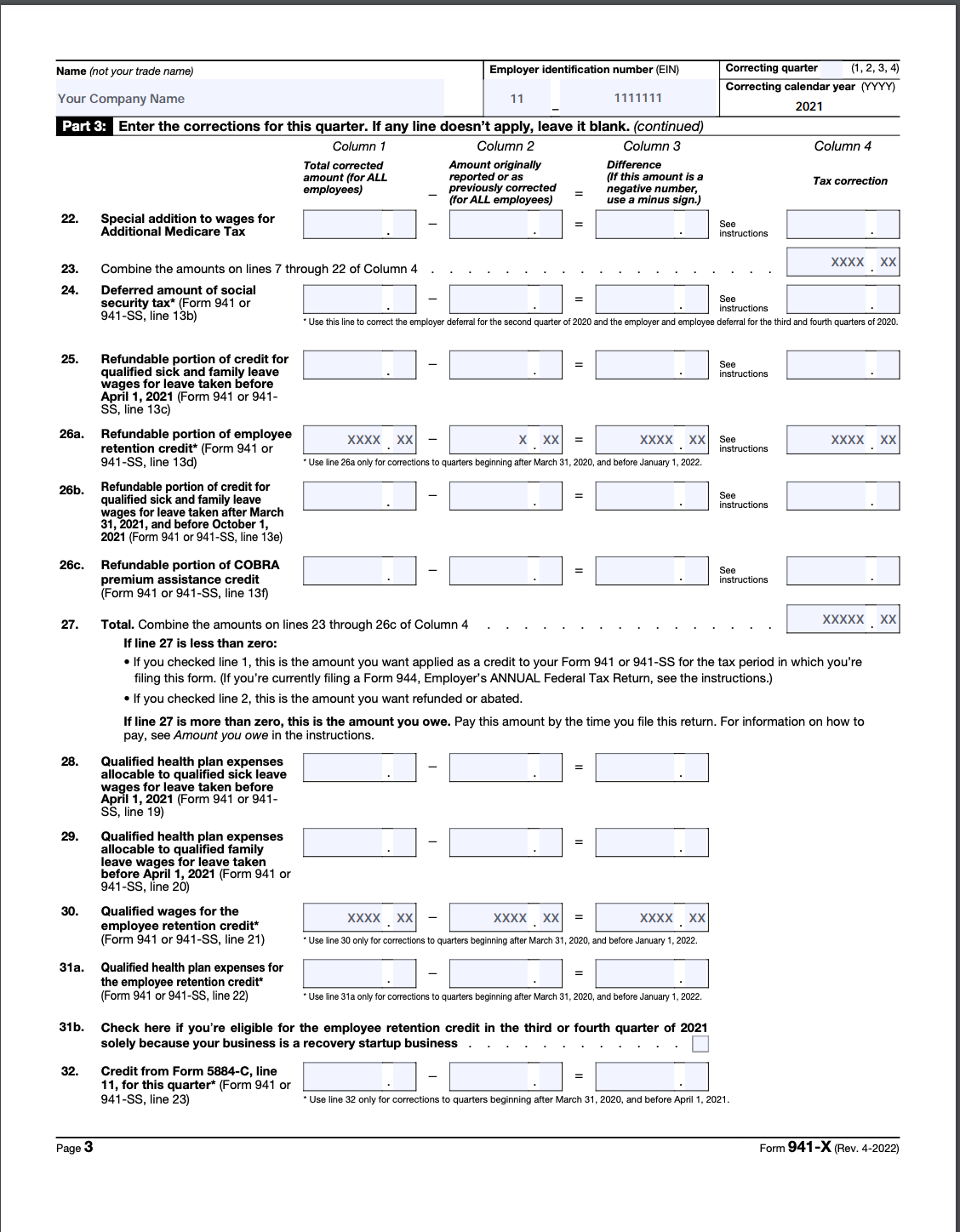

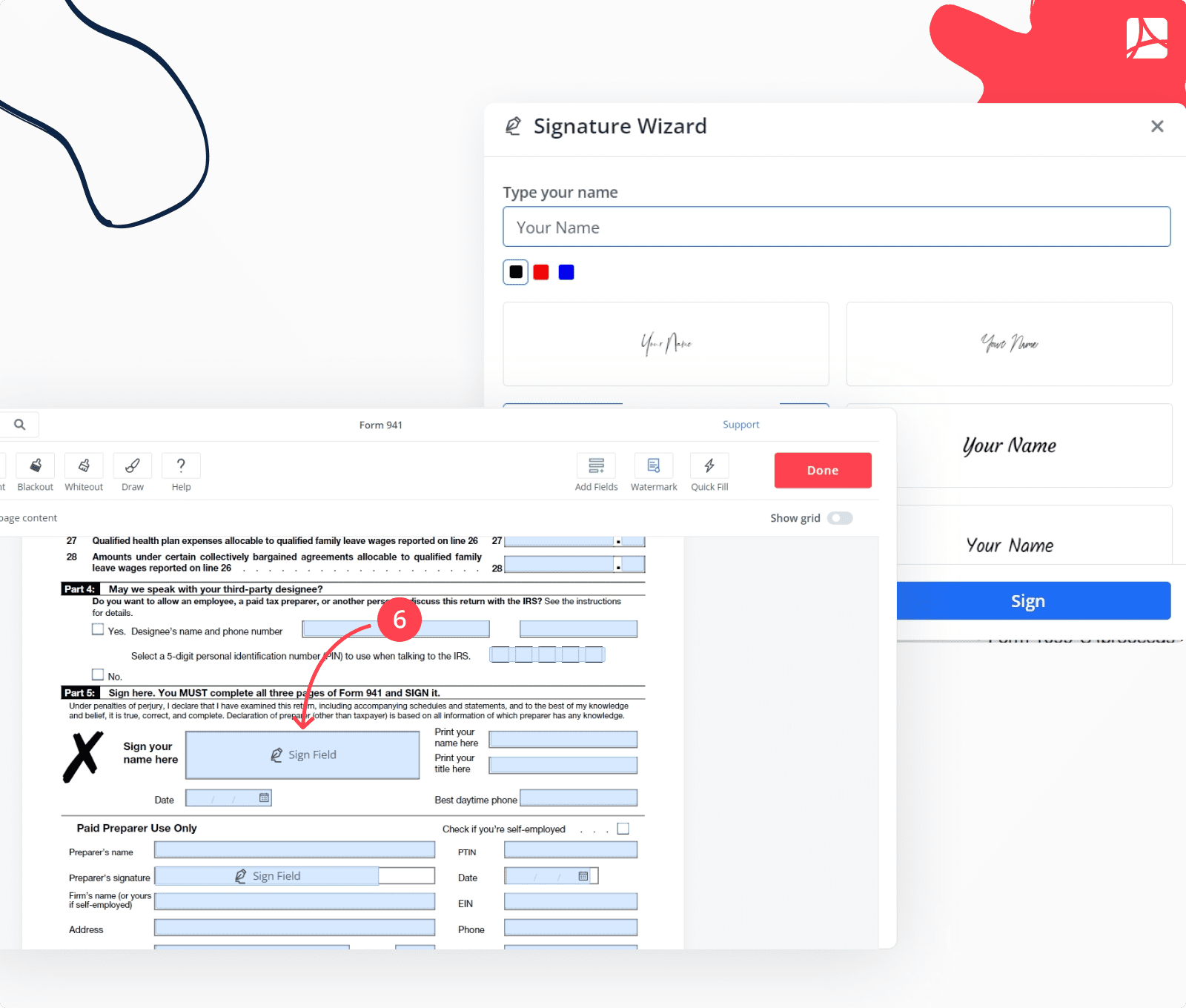

Form 941 X Print And Sign Form Online PDFliner

21 Printable Form 941 Templates Fillable Samples In PDF Word To Worksheets Library

Form 941 Fill Out Form 941 Tax 2025