Are you looking for a convenient way to file your taxes? The 1099 NEC printable form might be just what you need. This form is used to report non-employee compensation, making it easier for independent contractors and freelancers to report their income.

By using the 1099 NEC printable form, you can easily document your earnings and expenses, ensuring that you stay organized and compliant with tax regulations. This form is especially helpful for small business owners who work with independent contractors and need to report their payments.

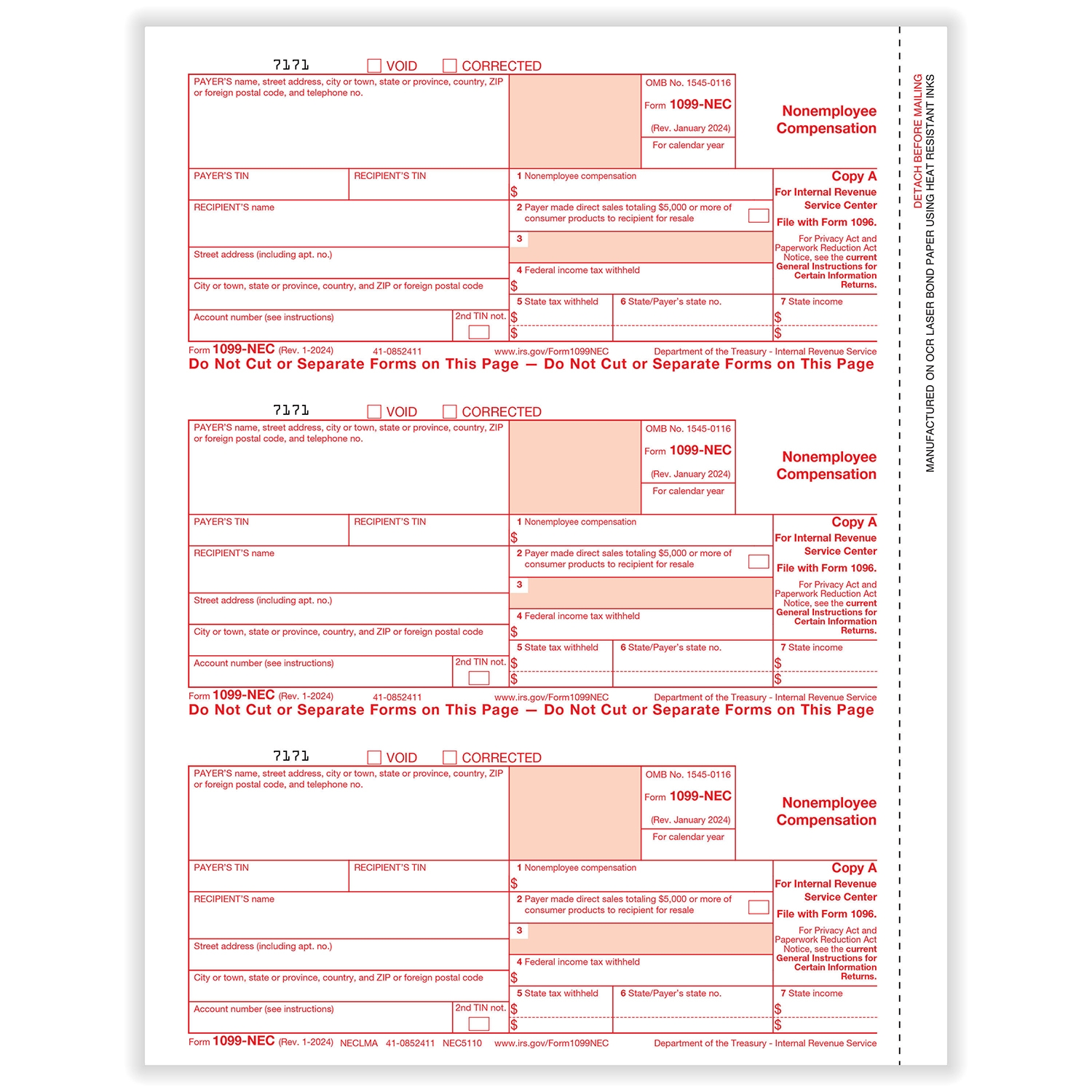

1099 Nec Printable Form

1099 NEC Printable Form: A Handy Tax Tool

With the 1099 NEC printable form, you can quickly and accurately report your income without the need for complicated accounting software or expensive tax professionals. Simply fill out the form with your earnings and expenses, then submit it to the IRS along with your tax return.

Whether you’re a freelancer, independent contractor, or small business owner, the 1099 NEC printable form can simplify the tax filing process and help you avoid costly mistakes. Take advantage of this handy tool to stay on top of your finances and ensure compliance with tax laws.

In conclusion, the 1099 NEC printable form is a valuable resource for anyone who needs to report non-employee compensation. By using this form, you can streamline the tax filing process and avoid potential penalties for incorrect reporting. Stay organized and compliant with the 1099 NEC printable form!

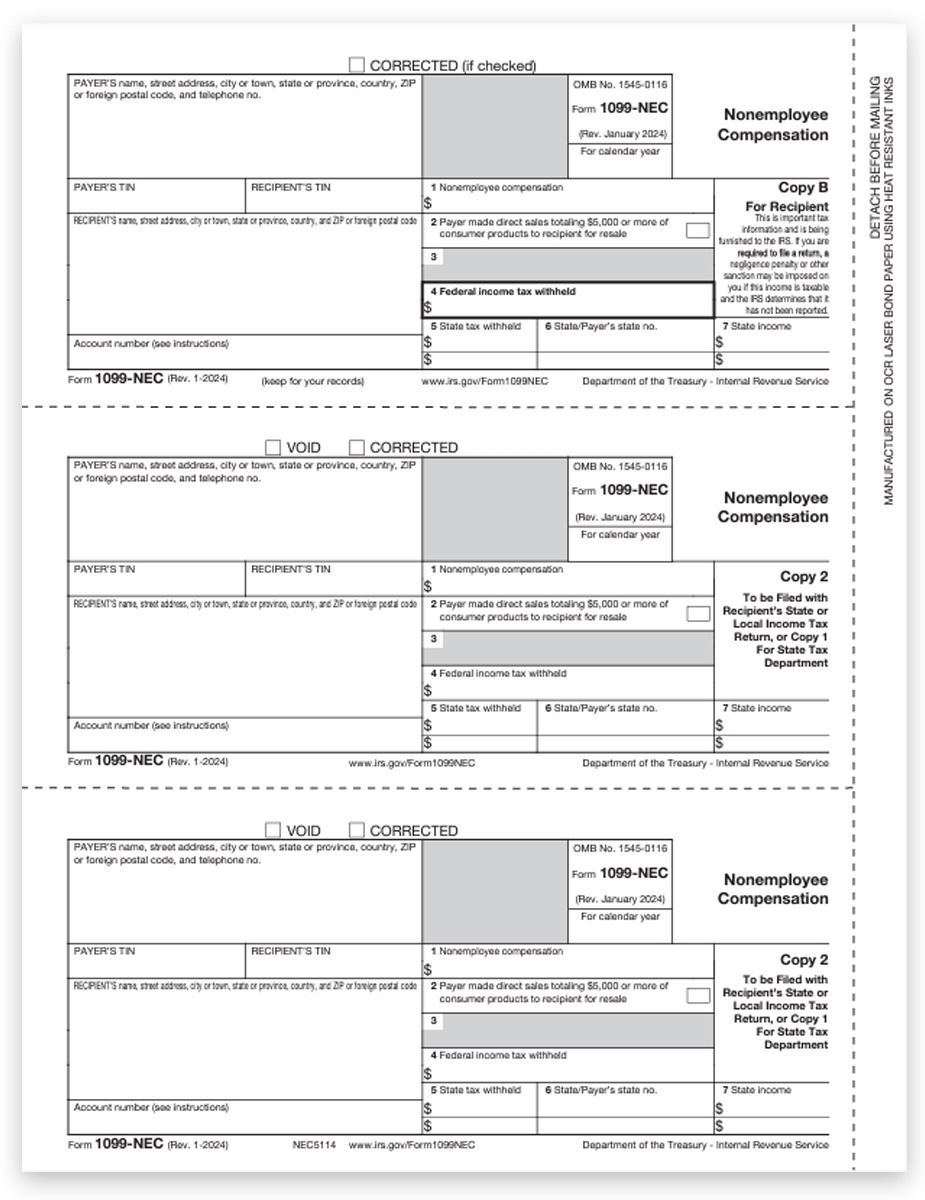

1099 NEC Forms Combined Copy B C 2 DiscountTaxForms

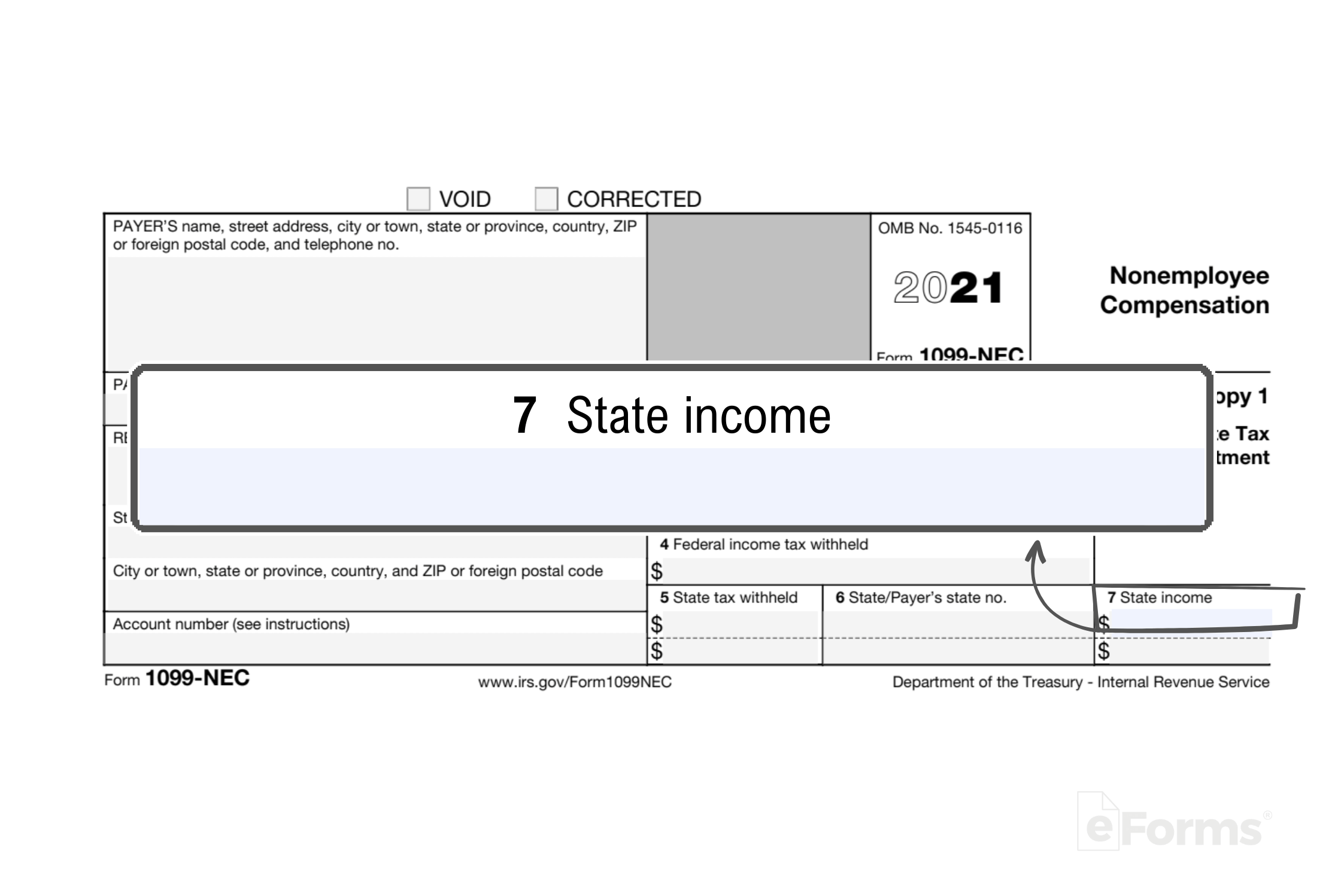

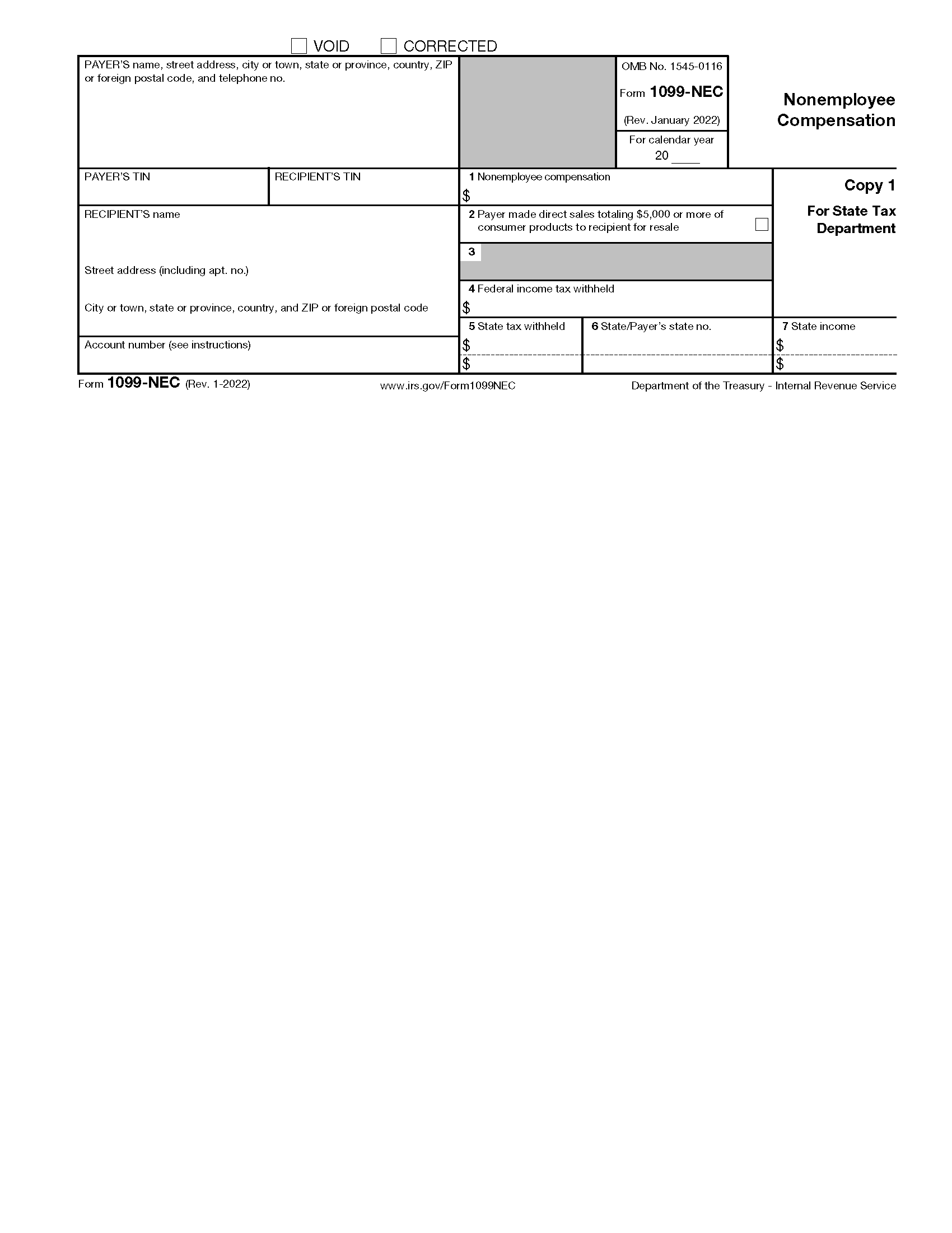

Free IRS 1099 NEC Form 2021 2025 PDF EForms

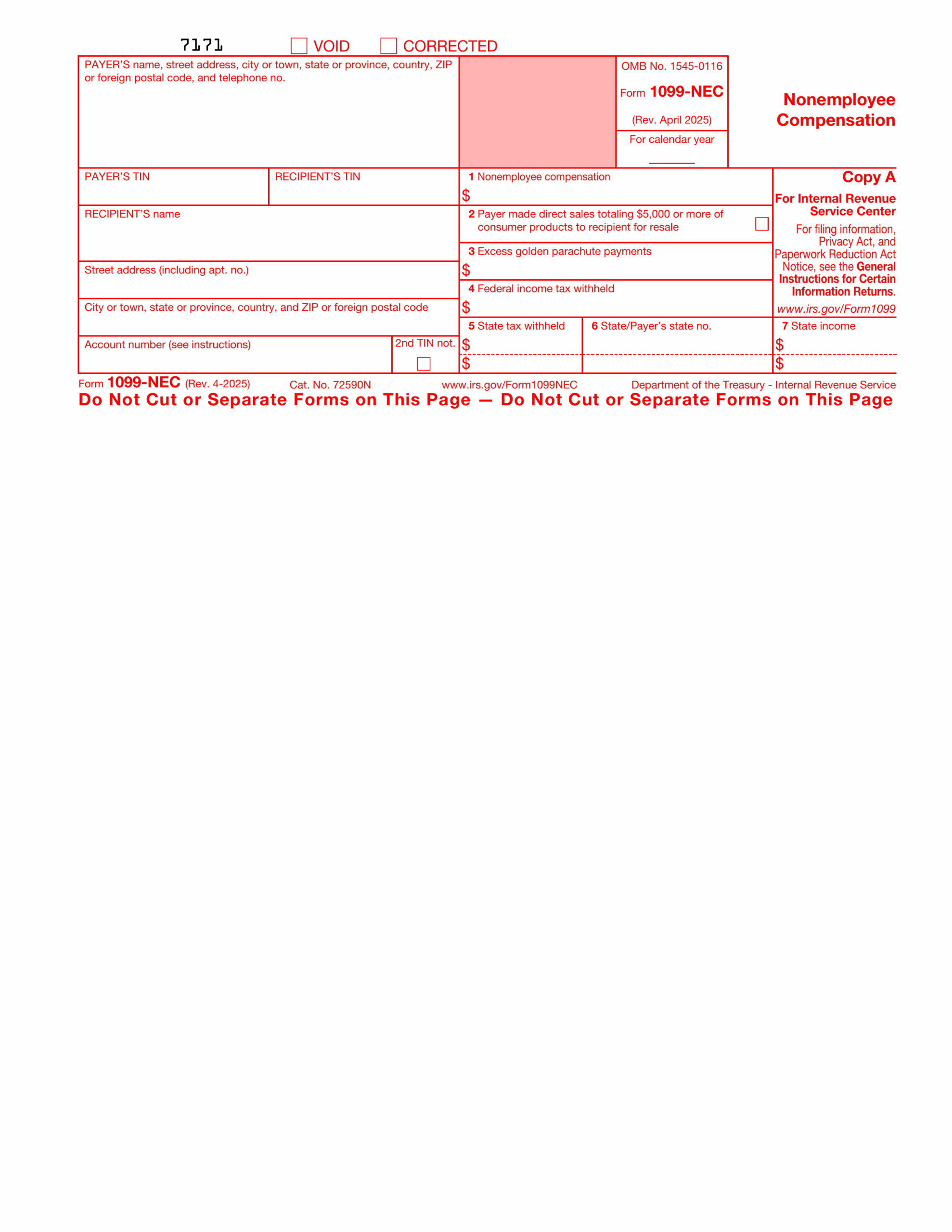

Form 1099 NEC 2024 2025 Fill And Download With Ease PDF Guru

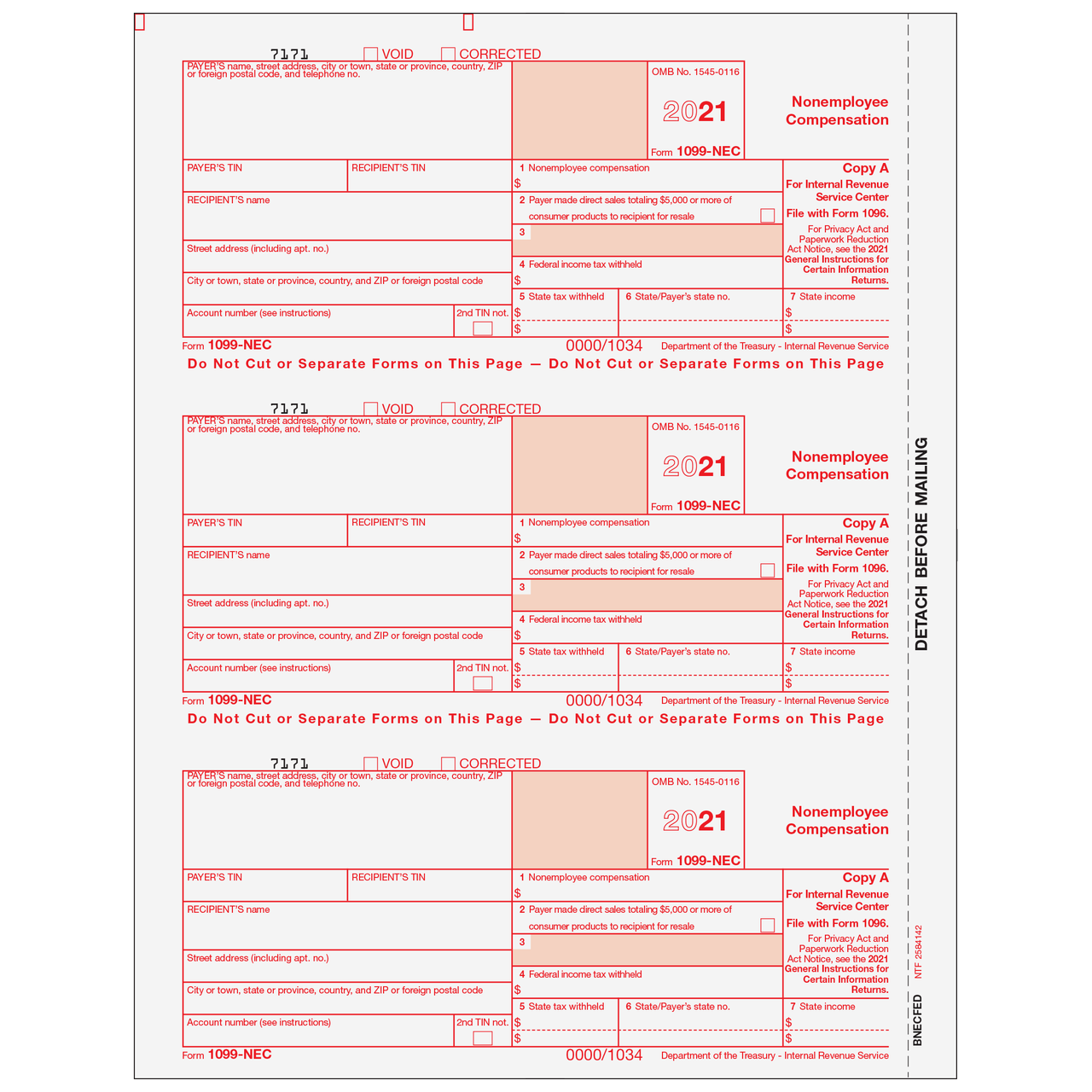

1099 NEC 3 Up Individual Fed Copy A Formstax

Free IRS 1099 Form PDF EForms