Need to file your taxes as a self-employed individual? Look no further than the 1099-NEC printable form. This form is essential for reporting non-employee compensation to the IRS.

Whether you’re a freelancer, independent contractor, or gig worker, the 1099-NEC form is your ticket to tax compliance. It’s important to accurately report your income to avoid penalties and ensure smooth sailing with the IRS.

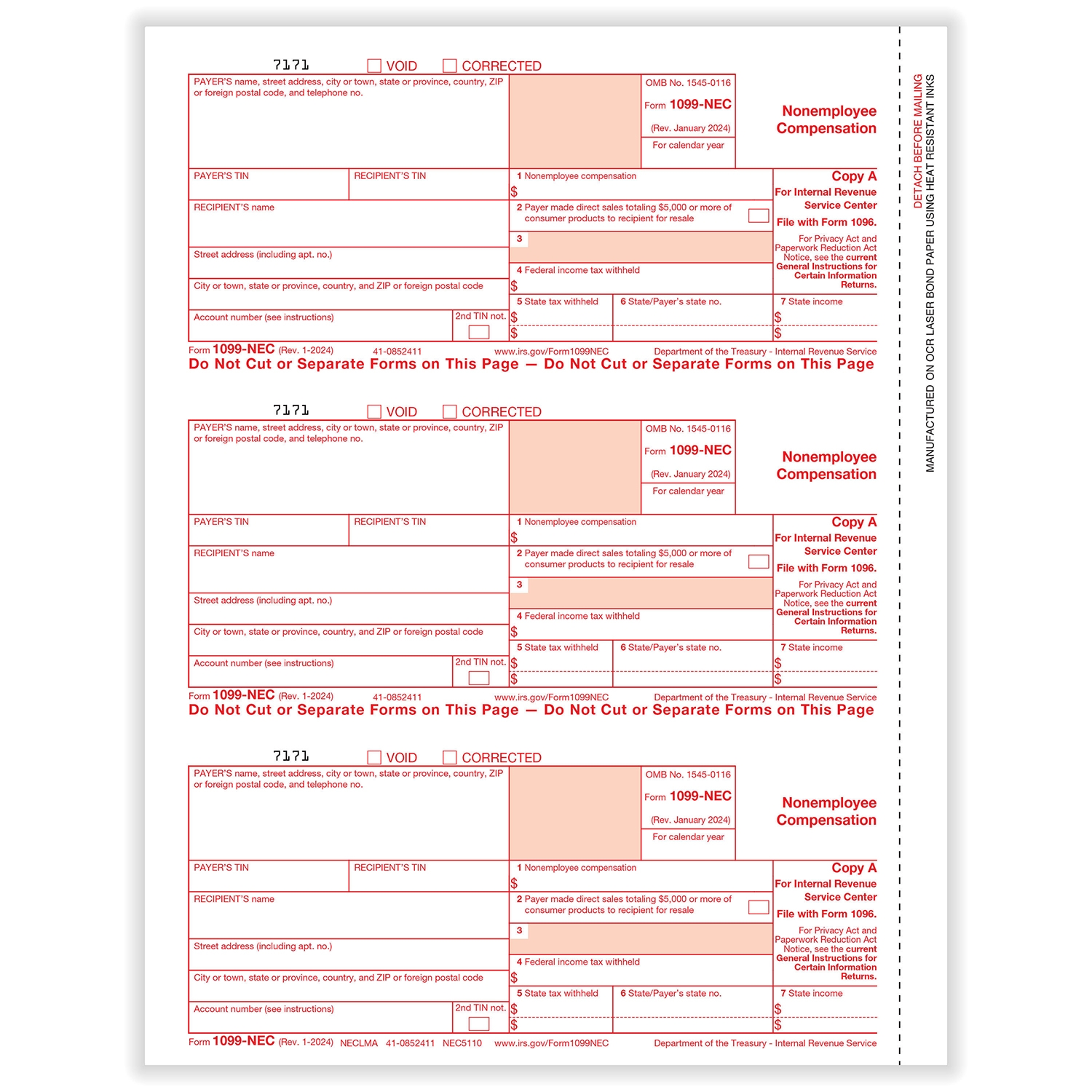

1099-Nec Printable Form

1099-NEC Printable Form: Your Tax Filing Companion

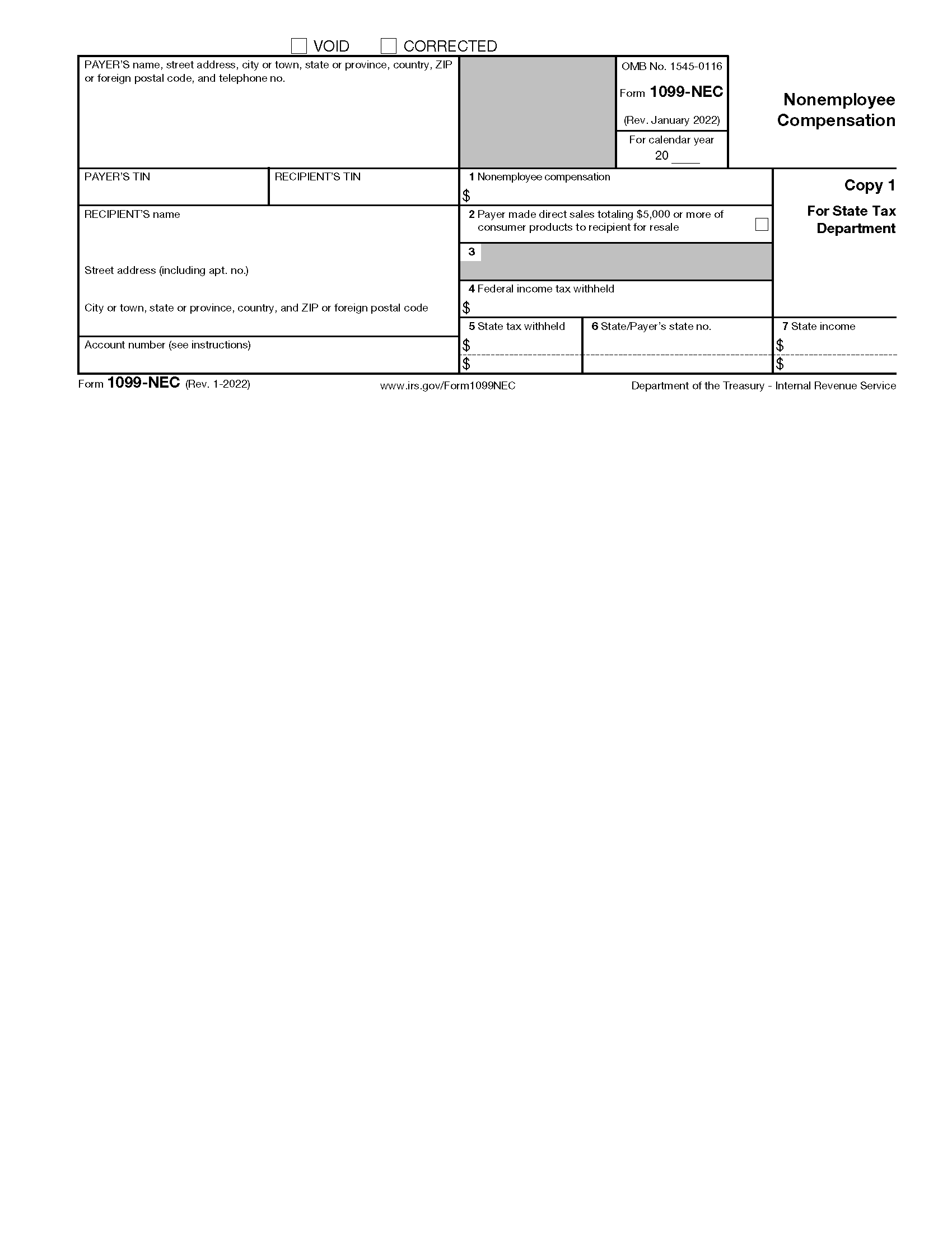

When filling out the 1099-NEC form, make sure to include your name, address, and Social Security number, along with the payer’s information. Double-check all figures to avoid any discrepancies that could trigger an audit.

Remember, the deadline for filing the 1099-NEC form is January 31st. Missing this deadline could result in fines from the IRS. So, don’t procrastinate – get your paperwork in order and submit your form on time.

Utilizing the 1099-NEC printable form is a straightforward way to stay compliant with tax regulations. By accurately reporting your income, you can avoid potential issues down the road and focus on growing your self-employed business.

So, don’t delay – download the 1099-NEC printable form today and take the first step towards stress-free tax filing. Remember, when it comes to taxes, it’s better to be safe than sorry!

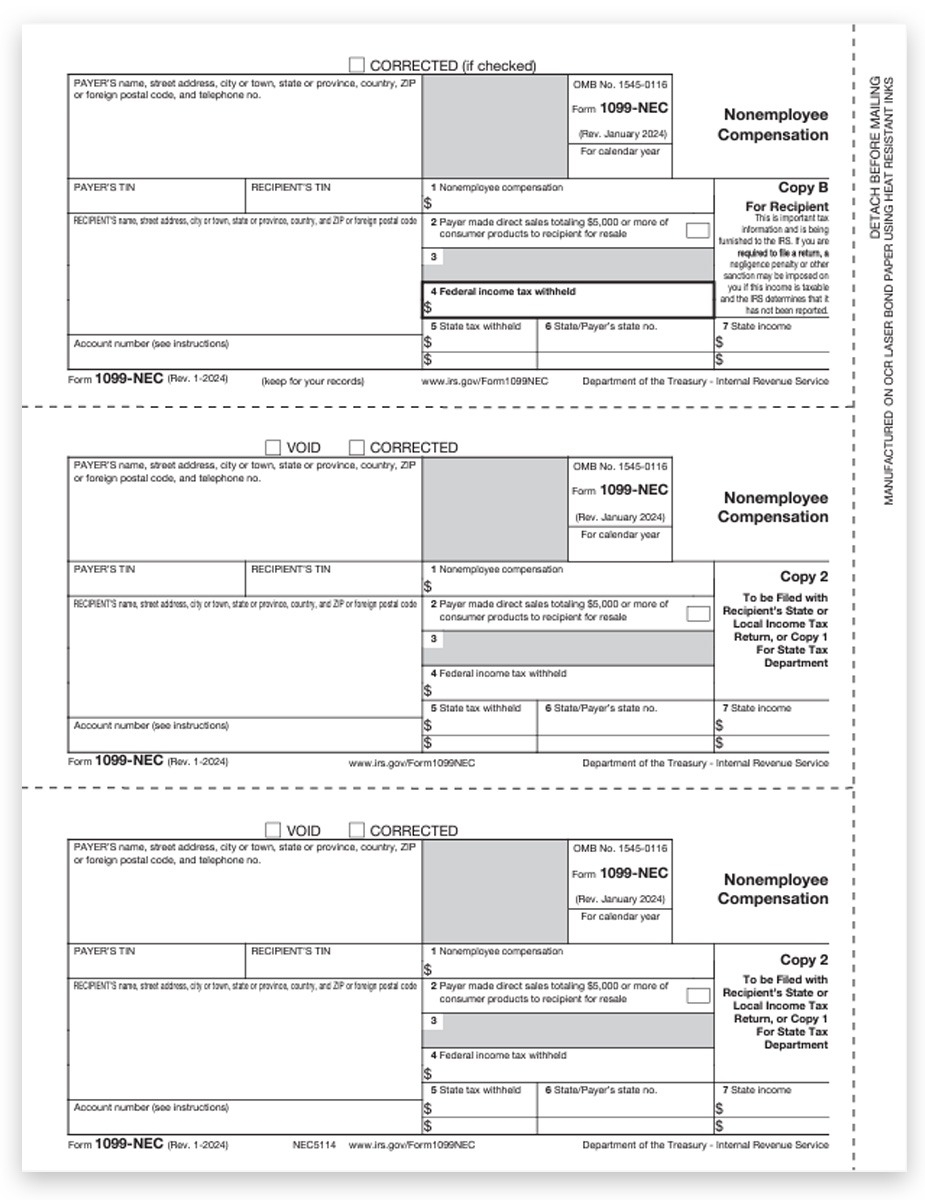

1099 NEC Forms Combined Copy B C 2 DiscountTaxForms

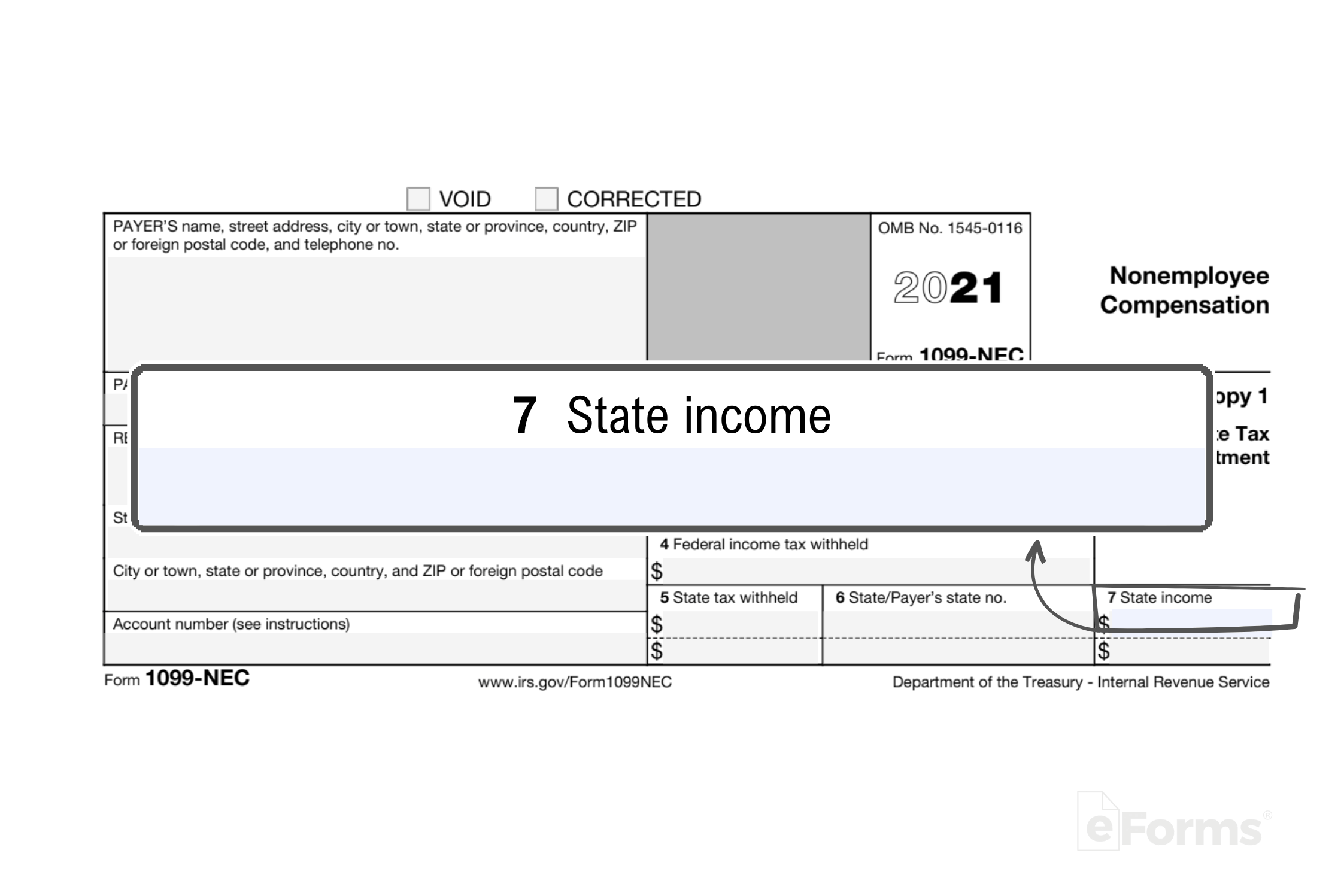

Free IRS 1099 NEC Form 2021 2025 PDF EForms

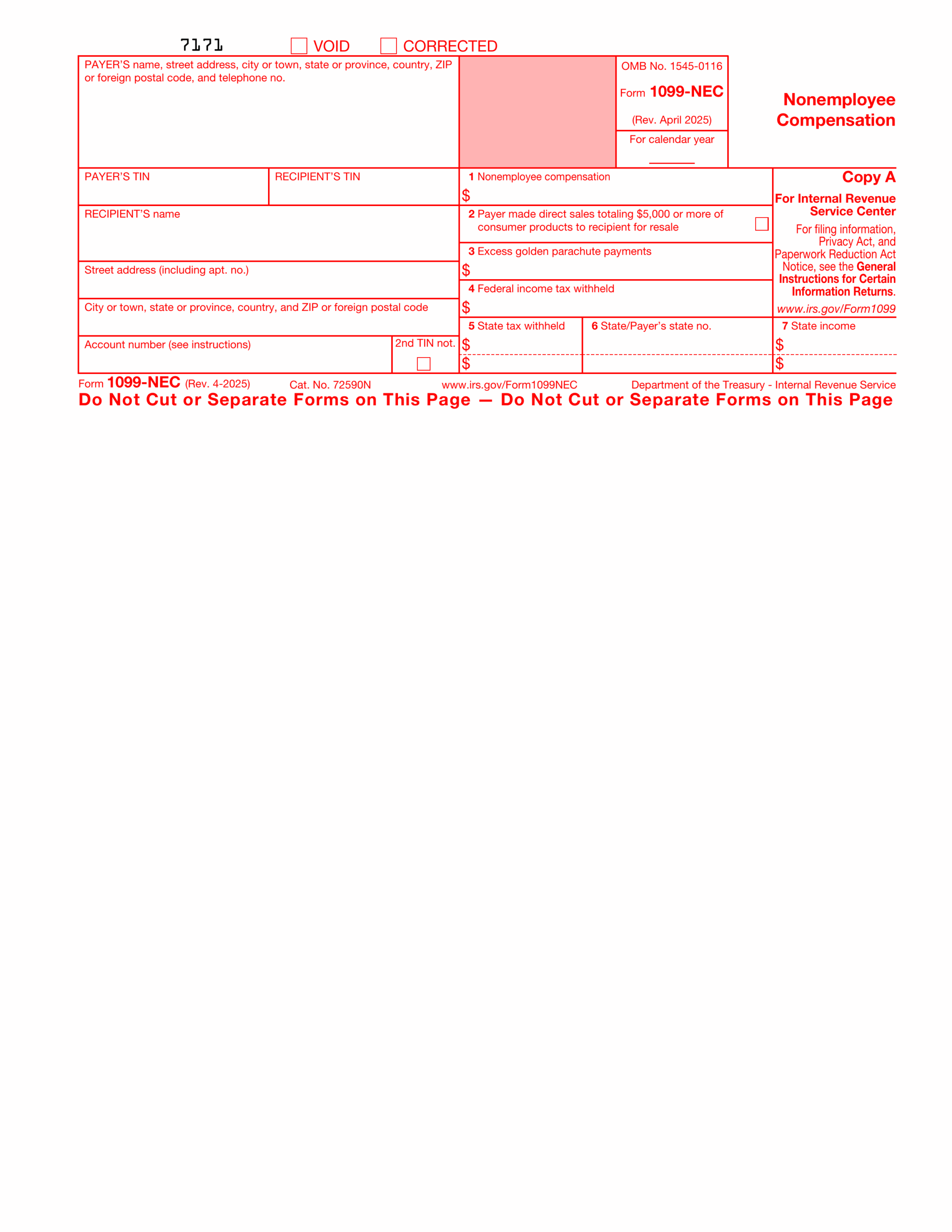

Form 1099 NEC 2024 2025 Fill And Download With Ease PDF Guru

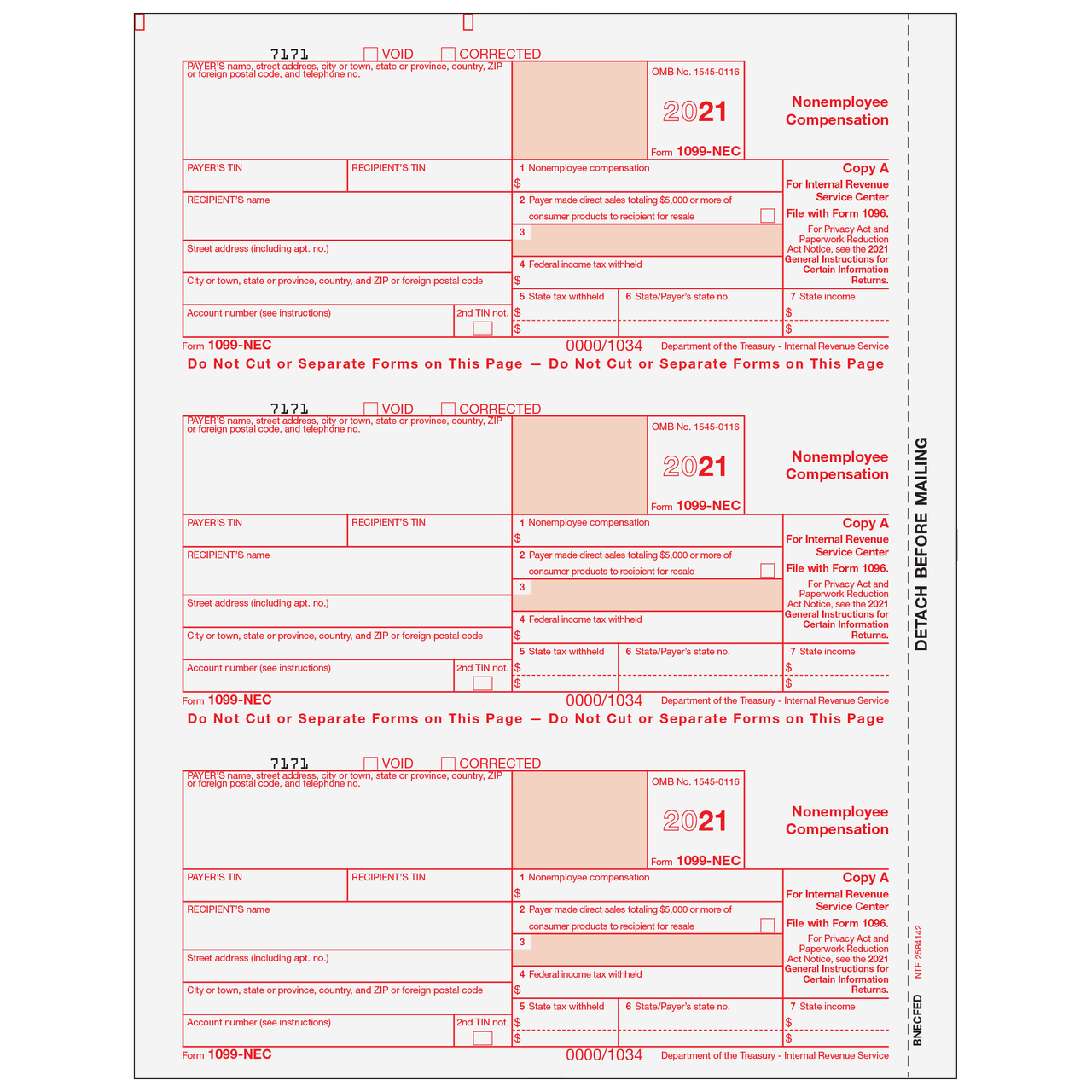

1099 NEC 3 Up Individual Fed Copy A Formstax

Free IRS 1099 Form PDF EForms